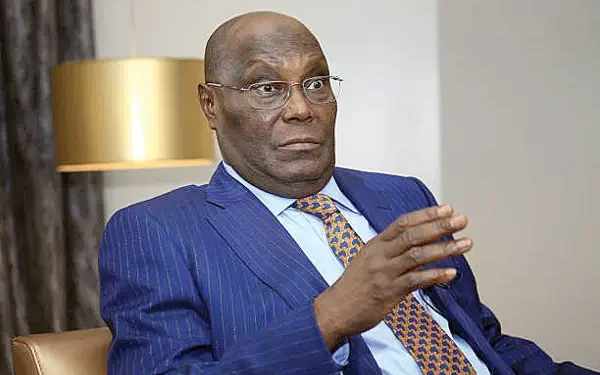

I’ve been inundated with inquiries of what I would have done differently if I were at the helm of affairs of our country.

I am not the president, Tinubu is. The focus should be on him and not on me or any other. I believe that such inquiries distract from the critical questions of what President Bola Tinubu needs to do to save Nigerians from the excruciating pains arising from his trial-and-error economic policies.

However, I understand and appreciate the challenges faced by citizens in seeking alternatives to what is not working for them.

I hope Tinubu and members of his administration are humble enough to borrow one or two things from our ideas in the interest of the Nigerian people. I would now go ahead and articulate some of our ideas that would have had the potential to transform our beloved country.

IN GENERAL

We would have planned better and more robustly: My journey of reforms would have benefited from more adequate preparations; more sufficient diagnostic assessment of the country’s conditions; more consultations with key stakeholders; and better ideas for the final destination.

We would have been guided by my robust reform agenda as encapsulated in ‘My Covenant With Nigerians’, my policy document that sought to, among others, protect our fragile economy against much deeper crisis by preventing business collapse; our document had spelt out policies that were consistent and coherent.

We would have sequenced my reforms to achieve fiscal and monetary congruence. Unleashing reforms to determine an appropriate exchange rate, cost-reflective electricity tariff, and PMS price at one and the same time is certainly an overkill. Add CBN’s bullish money tightening spree. As importers of PMS and other petroleum products, removing subsidy on these products without a stable exchange rate would be counterproductive.

We would have been more strategic in our response to reform fallout. We would not over-estimate the efficacy of the reform measures or underestimate the potential costs of reforms. I would recognise that reforms could sometimes fail. I would not underestimate the numerous delivery challenges, including the weaknesses of our institutions, and would work assiduously to correct the same. I would, as a responsible leader, pause, reflect, and where necessary, review implementation.

I would have led by example. Any fiscal reform to improve liquidity and the management of our fiscal resources must first eliminate revenue leakages arising from governance, including the cost of running the government and the government procurement process. I (and members of my team) would not have lived in luxury while the citizens wallow in misery.

We would have communicated more effectively with the people, with civility, tact, and diplomacy. Transparent communication with the public is essential to build public trust, which in turn is important to ensure that the public understands what the government is doing.

We would have consulted more with all stakeholders to learn, negotiate, adapt, and modify, among other policy goals.

We would have demonstrated more empathy. My Reforms would wear a human face.

We would have been more strategic in the design and implementation of reform fallout mitigating measures. I would not run a ‘palliative economy’ yet, we would have robust social protection programme that will offer genuine support to the poor and vulnerable and provide immediate comfort and security to enable them to navigate the stormy seas.

SPECIFIC MEASURES

We would have undertaken extensive reforms of the public sector institutions to maximize reform impact.

We would have placed special focus on security viz:

•Commenced on day one, the reform of security institutions with improved funding, and enhanced welfare. My Policy Document had spelt out a Special Presidential Welfare Initiative for security personnel that we would implement

•Adopted alternative approaches to conflict resolution such as diplomacy, intelligence, improved border control, deploying traditional institutions, and good neighbourliness.

We would have launched an Economic Stimulus Fund (ESF), with an initial investment capacity of approximately US$10 billion to support MSMEs across all economic sectors.

How would this have been funded?

Details are in my Policy Document.

Alongside the ESF, we would have launched a uniquely designed skills-to-job programme that targets all categories of youth, including graduates, early school leavers as well as the massive numbers of uneducated youth who are currently not in education, employment, or training.

To underscore our commitment to the development of infrastructure, an Infrastructure Development Unit (IDU) directly under the President’s watch would have come into operation. The IDU will have a coordinating function and a specific mandate of working with the MDAs to fast track the implementation of the infrastructure reform agenda within the framework provided herein. The IDU will hit the ground running in putting the building blocks for our private sector driven Infrastructure Development Fund (IDF) of approximately US$25 billion.

To engender fiscal efficiency and promote accountability and transparency in public financial management, we would have committed to a review of the current fiscal support to ailing State-Owned enterprises. We would’ve also begun a process review of government procurement processes to ensure value-for-money and eliminate all leakages.

We would have initiated a review of the current utilization of all borrowed funds and ensured that they were deployed more judiciously.

SUBSIDY REMOVAL

Yes, I have always advocated for the removal of subsidy on PMS because its administration has been mildly put, opaque with so much scope for arbitrariness and corruption. Mind boggling rent profit from oil subsidy accrued to the cabals in public institutions and the private sector.

I would have prioritized the following:

First, tackling corruption. Fighting corruption should have commenced with the repositioning of the NNPCL, which is a huge beneficiary of the status quo. Its commitment to reform and capacity to implement and enforce reforms is suspect. The subsidy regime has provided an avenue for rent seeking, and the NNPCL and its guardians will be threatened by reforms.

Second, paying particular attention to Nigeria’s poor refining infrastructure. We are by far the most inefficient OPEC member country in terms of both the percentage of installed refining capacity that works and the percentage of crude refined. We would’ve commenced the privatization of all state-owned refineries and ensure that Nigeria starts to refine at least 50% of its current crude oil output. Nigeria should aspire to export 50% of that capacity to ECOWAS member states.

Third, adopt a gradualist approach in the implementation of the subsidy reforms. Subsidies would not have been removed suddenly and completely. It is instructive that when I was Vice President, we adopted a gradualist approach and had completed phases 1 and 2 of the reform before our tenure ended. The incoming administration in 2007 abandoned the reforms, unfortunately. The majority of the countries that review or rationalize subsidy payments adopt a gradualist approach by phasing price increases or shifting from universal to targeted approach (Malaysia, 2022 and Indonesia, 2022 -2023). In many EU economies, complete withdrawal often takes 5 years to effect. The gradualist approach allows for adjustments, adaptation and minimizes disruptions and vulnerability.

Fourth, implement a robust social protection programme that will support the poor in navigating the cost-of-living challenges arising largely from reform implementation. We would’ve invested the savings from subsidy withdrawal to strengthen the productive base of the economy through infrastructure maintenance and development; to improve outcomes in education and healthcare delivery; to improve rural infrastructure and support livelihood expansion in agriculture; and develop the skills and entrepreneurial capacity of our youth in order to enhance their access to better economic opportunities.

ON FOREIGN EXCHANGE REFORMS

I also made a commitment to reform the operation of the foreign exchange market. Specifically, there was a commitment to eliminate multiple exchange rate windows. The system only served to enrich opportunists, rent-seekers, middlemen, arbitrageurs, and fraudsters.

What would I have done?

A fixed exchange rate system was out of the question because it would not be in line with our philosophy of running an open, private sector friendly economy. On the other hand, given Nigeria’s underlying economic conditions, adopting a floating exchange rate system would be an overkill. We would have encouraged our Central Bank to adopt a gradualist approach to FX management. A managed-floating system would have been a preferred option.