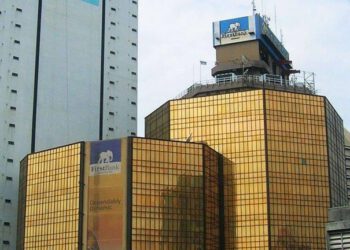

A group of shareholders holding 10% of the equity in First Bank of Nigeria Holdings Plc has formally requested an Extra-ordinary General Meeting (EGM) in accordance with Section 215(1) of the Companies and Allied Matters Act (CAMA). The company has 21 days to convene the meeting as mandated by law.

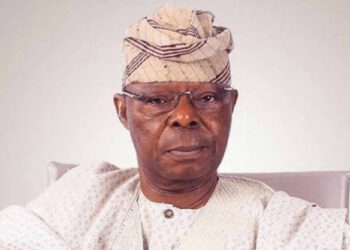

The primary agenda for the proposed EGM includes the removal of Mr. Femi Otedola as Chairman of FBN Holdings and Mr. Julius B. Omodayo-Owotuga, a non-executive director and Deputy Chief Executive of Geregu Power Plc.

The shareholders alleged that Mr. Otedola’s acquisition of significant shares, reportedly facilitated by former Central Bank of Nigeria (CBN) Governor Godwin Emefiele, has destabilized the financial institution. According to them, Mr. Emefiele had influenced the former CEO of First Bank, Dr. Adesola Adeduntan, to support Otedola’s takeover of the bank. This led to Otedola’s appointment as a non-executive director without necessary clearances from the Department of State Security (DSS) and the Economic and Financial Crimes Commission (EFCC).

Subsequently, Otedola allegedly orchestrated the removal of Dr. Adeduntan, followed by the exit of Mr. Tunde Hassan-Odukale, the former Chairman of First Bank of Nigeria Limited, and Mr. Tosin Adewuyi, who was passed over for the CEO position despite topping a recruitment assessment. Instead, the CEO position was given to Mr. Olusegun Alebiosu, who reportedly pledged loyalty to Otedola.

The shareholders accused Otedola of consolidating control over the bank by placing personal associates, including Mr. Omodayo-Owotuga, in key positions at both the HoldCo and the bank. They fear that the proposed private placement of N360 billion shares will further strengthen Otedola’s grip on the institution, allowing him to run it without checks and balances.

Concerns have also been raised about Otedola’s alleged history with non-performing loans and dealings with the Asset Management Corporation of Nigeria (AMCON). Shareholders argued that but for Emefiele’s influence, Otedola would not have passed the “fit and proper” test to assume such a pivotal role.

Furthermore, shareholders allege that Otedola has already secured a loan of $45–$50 million (approximately N90 billion) from the African Export-Import Bank (Afreximbank) to participate in the private placement, which they claim is his strategy to gain absolute control. They propose a rights issue or public offer instead, to ensure transparency and fairness.

Amid this turmoil, FBN Holdings has been at the center of a battle for the largest shareholder position. While the audited accounts for 2023 put Otedola’s shareholding at 9.41%, recent acquisitions suggest his stake has increased. However, Barbican Capital, linked to Honeywell Group’s Oba Otudeko, has emerged as the largest single shareholder with a 15.01% stake, according to Central Securities Clearing System (CSCS) data.

Barbican Capital has since sued FBN Holdings for misrepresenting its shareholding in the company’s audited financial statements.

Adding to the controversies, the bank recently laid off over 100 senior staff as part of a restructuring plan under Mr. Alebiosu’s leadership. Observers speculate that these dismissals may align with Otedola’s alleged efforts to replace key personnel with his allies.

The Security and Exchange Commission (SEC) and the Central Bank of Nigeria (CBN) are yet to comment on the situation, leaving the fate of the private placement and the calls for Otedola’s removal uncertain.

Culled from Arise News.