Polaris Bank has been commended by a cross section of customers for emerging the ‘MSME Bank of the Year 2022’ by the BusinessDay’s Banks and Other Financial Institutions (BAFI) Awards. The award is coming on the heels of the Bank’s recent strides in supporting SMEs and MSMEs.

Polaris Bank has been renowned for its intervention and provision of long-term financing support for Micro Small & Medium Enterprises (MSME) businesses across Nigeria.

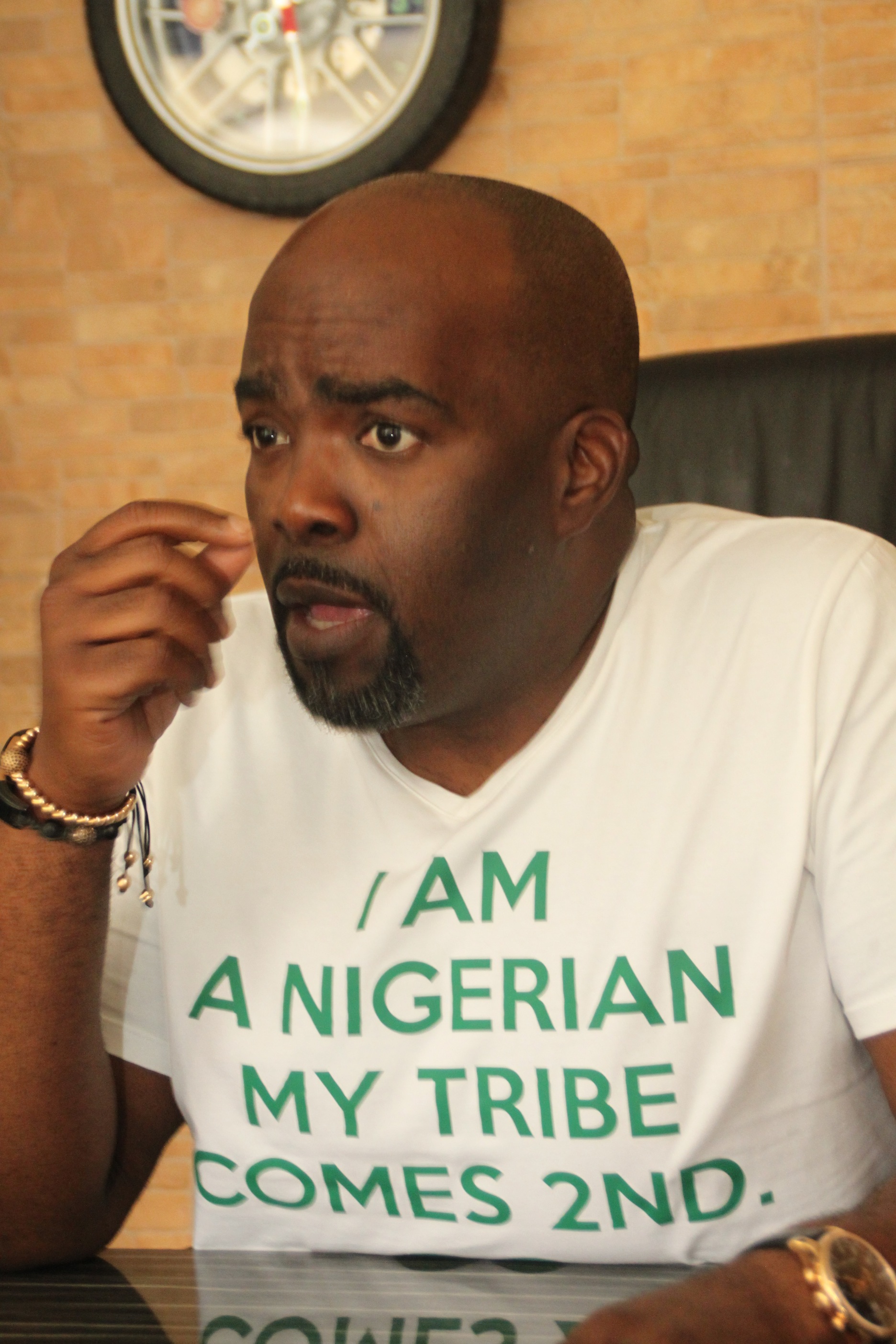

Mr. Kenneth Nvene, CEO of Girisim Construction Energy & Trade Nig. Limited and customer of the Bank, noted that the Bank is deserving of the recognition. Recounting his experience of securing a business loan from the Bank, Mr. Nvene said that the loan has been of immense benefit to the day to day running of his company especially because the interest rate is fair and the approval time for securing the loan was without delay.

Another customer of the Bank, Ms. Ngozi Okoli, CEO, Emmy Godstime Rice Ventures, who secured an overdraft facility, said Polaris Bank is worthy of the recognition while also acknowledging that her business has been enhanced as a result. In her words, “I was able to stock up goods and meet my customers’ demands as and when due which is for me, the game chea of business.” Because of her experience, she went on to refer Polaris Business loan to another company known as Kambel Rice Ltd.

Polaris Bank‘s Group Head, Products and Market Development, Mrs. Adebimpe Ihekuna described the award as a welcome development and attributed it to the Bank’s innovative way of helping MSMEs meet their business objectives.

Mrs. Ihekuna noted that the Bank’s support for the growth and development of MSMEs in the country stems from a recognition of this sector as a critical agent of economic transformation in Nigeria.

She explained further that over the years, Polaris Bank’s support to MSMEs through a comprehensive business advisory system, has helped especially small businesses to weather the storm of the peculiar business environment of Nigeria thereby repositioning many of them for sustainability and growth.

Polaris Bank through its SME focused products and initiatives has offers some of the following services to customers: Business Registration Support, Polaris SME Academy, SME Digital Marketing Training, Polaris Business Advisory, Polaris SME Toolbox, Polaris E-Commerce Platform.

Loans to MSMEs in Polaris Bank is fully digitized, end-to-end with instant disbursement. No branch visitation or paper work is required. Also, non-account holders are also profiled digitally and can access loan instantly, having been profiled, a unique feat only available and offered at Polaris Bank.

Polaris Bank in May this year launched a N1billion fund for MSMEs in partnership with Lagos State Employment Trust Fund (LSETF).

Prior to the launch of the N1billion MSME Fund, Polaris Bank had committed, and indeed, provided close to N70billions to Micro, Small, and Medium Enterprise (MSMEs) from January 2021 till date.

Report from the Nigeria Bureau of Statistics reveals that Small and Medium scale Enterprises (SMEs) in Nigeria have contributed about 48% of the national GDP in the last five years. With a total number of about 17.4 million, they account for about 50% of industrial jobs and nearly 90% of the manufacturing sector, in terms of number of enterprises.

The BusinessDay BAFI Awards are recognized and justly regarded as an industry standard for premier banking and financial services excellence The yearly awards recognise deserving financial institutions and corporate organizations, that drive innovation in Nigeria’s financial landscape. They reflect on the achievement, strategy, progressive and inspirational changes taking place within the financial sector.

Polaris Bank, adjudged Digital Bank of the Year 2021 and 2022, is a future-determining Bank committed to delivering industry-defining products for individuals and businesses.