The Executive Chairman of the Nigeria Revenue Service (NRS), Dr. Zacch Adedeji, has called on Nigerians to thoroughly study the provisions of the 2025 Tax Reform Law before forming opinions, warning against what he described as premature criticism of the policy.

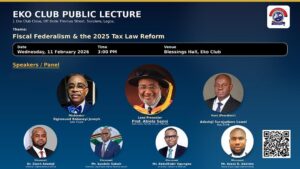

Speaking at the Eko Club Public Lecture held at the Blessings Hall in Surulere, Lagos, Dr. Adedeji expressed concern that many citizens had condemned the new tax regime without understanding its contents.

According to him, the reform, initiated by the Federal Government, is designed to strengthen the nation’s fiscal structure and stimulate economic growth.

The lecture, themed “Fiscal Federalism and the Year 2025 Tax Law Reform,” brought together policymakers, tax administrators, legal experts, and stakeholders to dissect the far-reaching implications of the new law.

Represented by Mr. Olufemi Olarinde, the NRS boss described the 2025 reform as the most comprehensive tax policy shift ever undertaken in Nigeria. He explained that the law provides significant relief measures, including exemptions for numerous companies and individuals. Notably, he said, the minimum tax previously imposed on companies that recorded no profits has been completely abolished.

He further revealed that 18 items have been either exempted or zero-rated under the new framework, including medical services. This, he noted, is aimed at promoting productivity and reducing the overall cost of goods and services across the country.

Also speaking at the event, the Chairman of the Lagos State Internal Revenue Service (LIRS), Dr. Ayodele Subair, said the reform is structured to enhance the purchasing power of Nigerians. Represented by Tokunbo Akande, Subair maintained that increased disposable income under the new tax regime would stimulate economic activities and drive growth.

However, he expressed disappointment that public discourse around the reform had not been sufficiently driven by Nigerians themselves. He urged citizens to comply voluntarily with the new tax provisions, stressing that non-compliance attracts stiff administrative penalties. According to him, tax authorities are empowered to impose sanctions for infractions without necessarily resorting to courts or tribunals.

Subair explained that routine notices issued to companies and residents are meant to create awareness about compliance obligations, noting that taxation is often perceived as a burden due to limited understanding of its broader economic benefits.

In his presentation, the lead discussant, Professor Abiola Sanni, Dean of the Faculty of Law, University of Lagos, argued that resistance to the reform is being fueled by wealthy and influential individuals who have misrepresented its intent. He described the 2025 Tax Reform as a national initiative that requires alignment by state governments through domestication for effective implementation.

Professor Sanni added that the new law strengthens the institutional capacity of the NRS and preserves a single-digit tax framework at the federal level. However, he observed that more clarity is needed in addressing the activities of state and non-state actors involved in illegal tax collections, commonly referred to as multiple taxation.

Earlier in his welcome address, the President of Eko Club, Surajudeen Adedeji Lawal, stated that the public lecture was organized as part of the club’s corporate social responsibility to enlighten citizens on the objectives and mechanics of the new tax law. He emphasized the need to dispel misconceptions surrounding the reform.

Lawal noted that while death and taxes remain inevitable, Nigeria continues to struggle with revenue generation outside the oil sector due largely to inadequate tax compliance.

He described the lecture as timely, given the widespread reactions to the reform, and said the club considered it necessary to provide a platform for informed engagement.