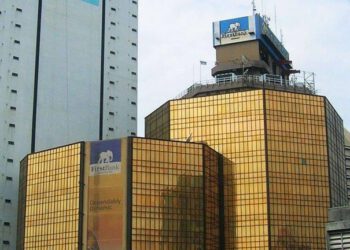

In a scandal that has sent tremors through Nigeria’s financial landscape, First Bank, the nation’s oldest banking institution, finds itself at the epicenter of a massive fraud controversy.

The theft of N40 billion, allegedly orchestrated by an insider over a span of two years, has raised pressing questions about internal controls and corporate governance within the banking giant.

The revelation of this financial debacle follows the abrupt resignation of Adesola Adeduntan, the bank’s former Chief Executive Officer, who stepped down in April amidst the World Bank/IMF meetings in Washington.

Adeduntan, who had led the bank since 2014, cited a desire to “pursue other interests” in his resignation letter, leaving the true motives behind his departure open to speculation.

In the wake of Adeduntan’s resignation, First Bank swiftly appointed Olusegun Alebiosu as the new Managing Director and Chief Executive Officer.

Alebiosu, a seasoned risk management expert with extensive experience in compliance and risk mitigation, was formerly the bank’s Chief Risk Officer. His appointment hints at the bank’s urgent need to fortify its internal controls.

The magnitude of the fraud was first brought to light by a report from TechCabal and later amplified by Ndubuisi Ekekwe, the lead faculty at Tekedia, who questioned the sudden leadership change at First Bank. Ekekwe’s comments on social media ignited a firestorm of discussions, exposing the extent to which one individual allegedly manipulated the system to siphon off billions.

A letter dated May 10, 2024, addressed to the Lagos State Police Commissioner, provided official confirmation of the fraud.

The letter detailed how the fraudulent transactions were funneled through various accounts, eventually dispersing into over 1,190 accounts across multiple banks. It was a scheme of staggering complexity, involving transfers to the alleged perpetrator’s wife’s account and further disbursements to 34 other beneficiaries.

Social media has been ablaze with reactions, with many questioning the efficacy of First Bank’s internal safeguards. “Banks and other financial institutions need elevated risk management and fraud detection systems,” one user on X (formerly Twitter) commented, emphasizing the need for robust defenses against technological vulnerabilities.

The incident has also revived memories of past banking scandals. Dr. A. Turumgbe recalled a similar situation two decades ago when he worked with a bank on Ahmadu Bello Way in Victoria Island, Lagos. Another user speculated that the fraud might have been facilitated by “dispense errors” and that the bank’s detection systems were crippled by a recent submarine cable issue affecting telecommunications and banking operations.

Amidst the chaos, several pointed questions emerge: How did such a significant fraud go unnoticed for so long? Where were the checks and balances, the automated systems, the audit trails, and the supervisory oversight? One commentator, Nkwuda Chinedu, encapsulated the frustration by asking, “Has the staff no supervisor and no audit for the period?”

The scandal at First Bank underscores a broader issue within Nigeria’s financial sector—an urgent need for enhanced transparency and accountability. It serves as a stark reminder of the vulnerabilities that exist within even the most venerable institutions, and the critical importance of rigorous risk management practices.

As First Bank moves forward under new leadership, the spotlight remains fixed on how it will address the lapses that allowed this fraud to occur and what measures will be implemented to prevent such breaches in the future.

The N40 billion scandal is not just a tale of financial impropriety but a call to action for all financial institutions to reassess and strengthen their internal controls in an era where technological exploitation can wreak unprecedented havoc.